agents vs clouds

uneasy alliance w/ unclear battle lines

note: i did finish the devin write up… but chose to self censor it bc i didn’t want to piss people off, i’m a paid shill ok integrity isn’t my strong suit — hence the lack of content. if i find a way to spin the devin piece positively, i’ll put that out there

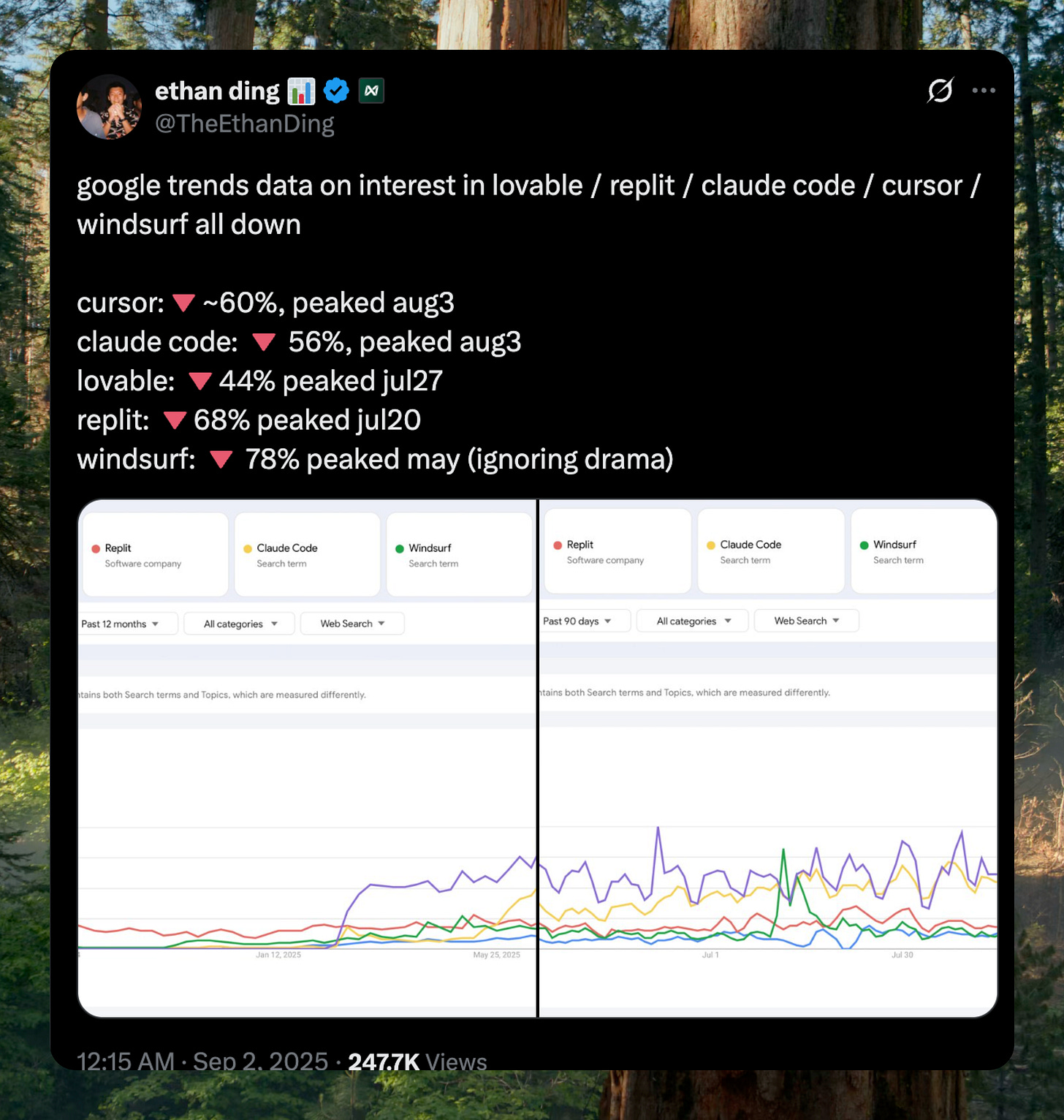

every single ai coding tool peaked this summer and has been bleeding interest ever since:

cursor: 🔻60%, peaked aug 3

claude code: 🔻56%, peaked aug 3

lovable: 🔻44%, peaked jul 27

replit: 🔻68%, peaked jul 20

windsurf: 🔻78%, peaked may (ignoring acquisition drama)

the gold rush is over. the miners are going home. but someone still needs to sell the shovels.

you could read this as the bubble popping. tourists tried ai coding, got frustrated when it didn’t work like the demos, and went back to writing their own for loops.but there’s another interpretation: the market is sorting itself into people who actually use these tools daily and people who don’t.

either way, the market doesn’t seem like it’s going to keep exploding at it’s prior trajectory, which means we’re going to have to find another way other than uber-type growth + free tokens to build sustainable businesses.

so to find those margins, we look to a more traditional source of margins: cloud infra

tokens drive cloud cloud consumption

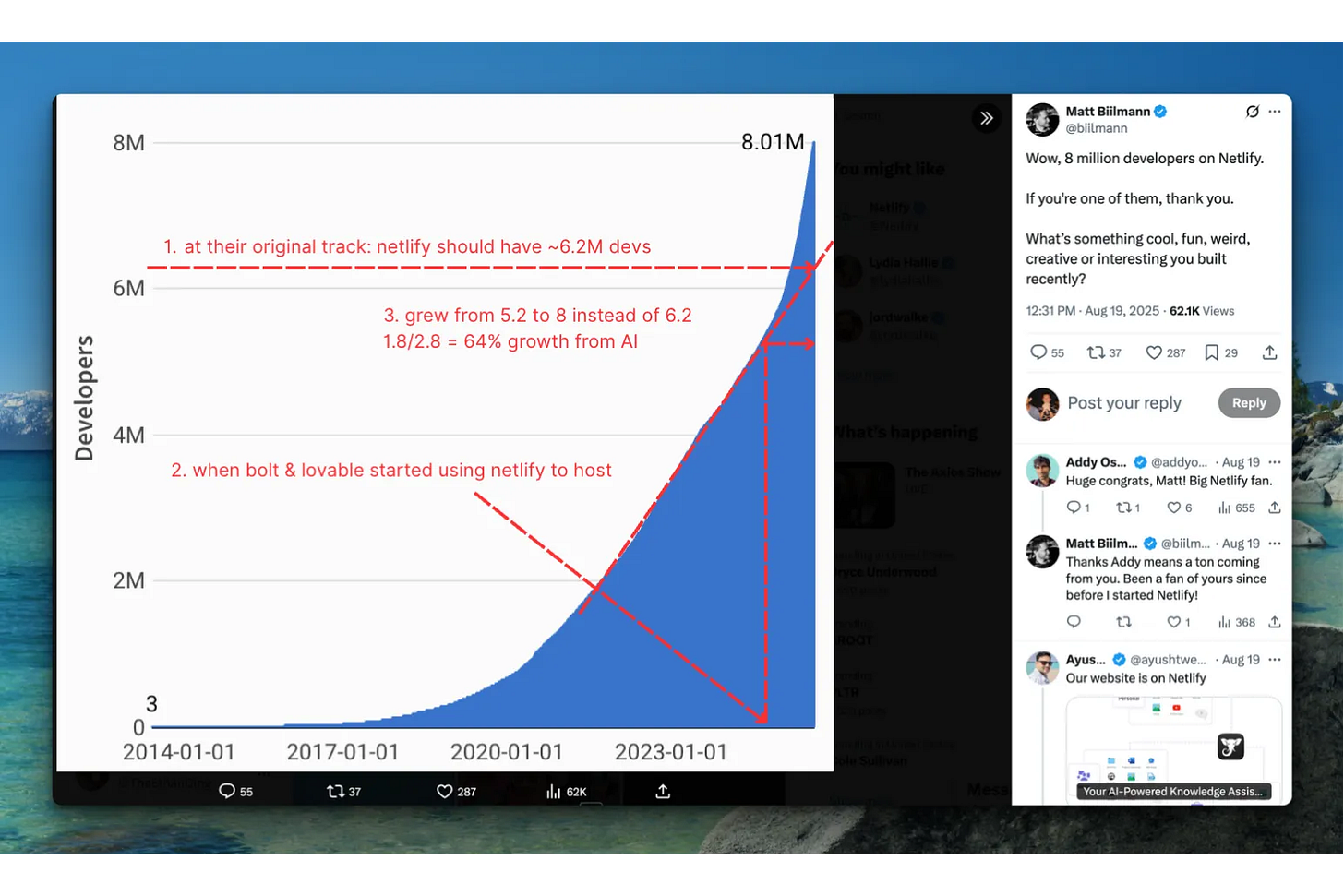

matt biilmann, the ceo of netify, recently tweeted that they had hit $8M developers. if you zoom in. and extrapolate the lines — there’s a dramatic steepening of the curve around the time when lovable / bolt took off and let their agents deploy on netlify. bolt even recently released bolt cloud, which is built entirely around netlify.

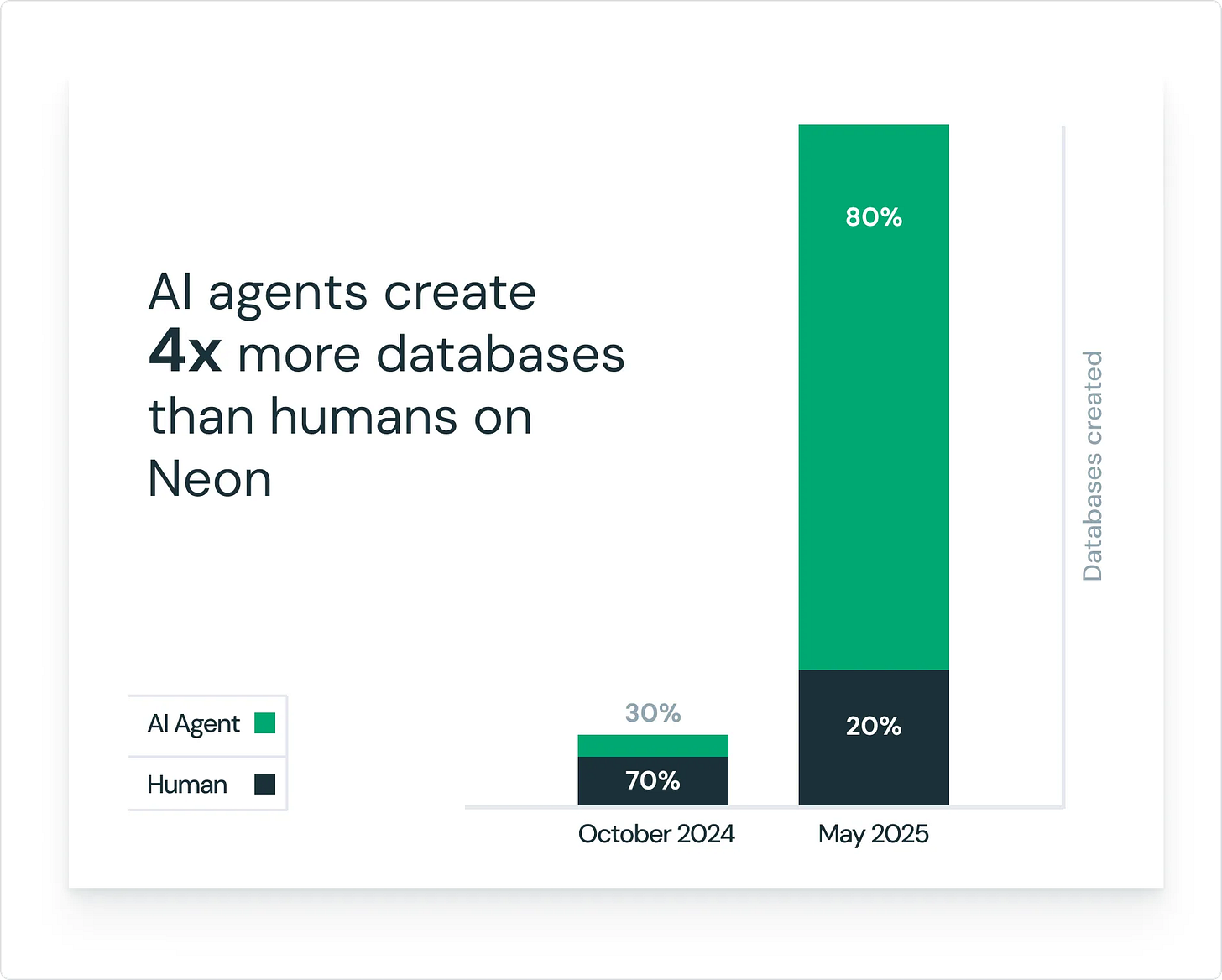

taking that math that i sketched out in the chart out, if we assume that the surge is largely attributable to the ai coding agents, then 64% of their user growth are currently from ai agents and not human developers, which is in line with the numbers published by neon at the time of the databricks acquisition.

netlify has been playing the same game for years: charge 80% margins to host websites because developers are expensive. if you’re paying someone $200k a year, what’s $8/month for hosting?

but we just inverted that entire cost structure. an app that cost $200k in developer salaries now costs $3 in anthropic tokens. when lovable generates a react app in 6 minutes for the price of a coffee, suddenly that $8/month hosting fee becomes your entire business model.

do the math on netlify’s growth: 64% of their recent user growth comes from ai agents, not humans. same story at neon database during their databricks acquisition. more databases created by agents than people now.

the coding layer went to zero. the infrastructure demand exploded. netlify went from being a tiny tax on expensive labor to being the main beneficiary of free labor. we spent three years trying to eliminate developers. turns out we just eliminated their paychecks - the hosting bill stayed exactly the same.

tokens control cloud consumption

so seems like the perfect play for netlify right?

same dynamic here, except reversed. bolt hemorrhages $50 in anthropic tokens to generate a $20 subscription

netlify captures all the 80% gross margins on cloud hosting. bolt generates demand, netlify captures margins.

but that also means bolt can choose to roll their own cloud one day, creating a fascinating prisoner’s dilemma:

bolt needs a part of those infrastructure margins to survive

netlify needs bolt’s token stream for volume

eric simons could wake up tomorrow and point everything to cloudflare

or worse, build their own hosting

that’s exactly what replit and vercel figured out. when an agent creates an app on replit, every dollar of infrastructure margin stays in house. vercel v0 does the same thing. create with ai, deploy on vercel, pay vercel forever. every single user of replit is a user who’s ideas for websites will never be hosted on netlify

the lesson is obvious: whoever controls the tokens controls the infrastructure. and whoever controls both controls the margins.

anthropic isn’t sitting still either. claude desktop now ships with “hostable artifacts” that let you deploy web apps directly from chat. they added the ability to see your figma designs and do pixel-perfect copies - which was lovable’s original differentiating pitch. this isn’t anthropic being nice to developers. this is anthropic realizing that the token stream alone isn’t enough. every artifact that gets deployed somewhere else is margin they’re not capturing. every app built with claude but hosted on netlify is money flowing to netlify instead of them.

the pattern is clear: everyone who generates tokens wants to capture the infrastructure spend that follows. and everyone who owns infrastructure wants to generate the tokens that drive demand.

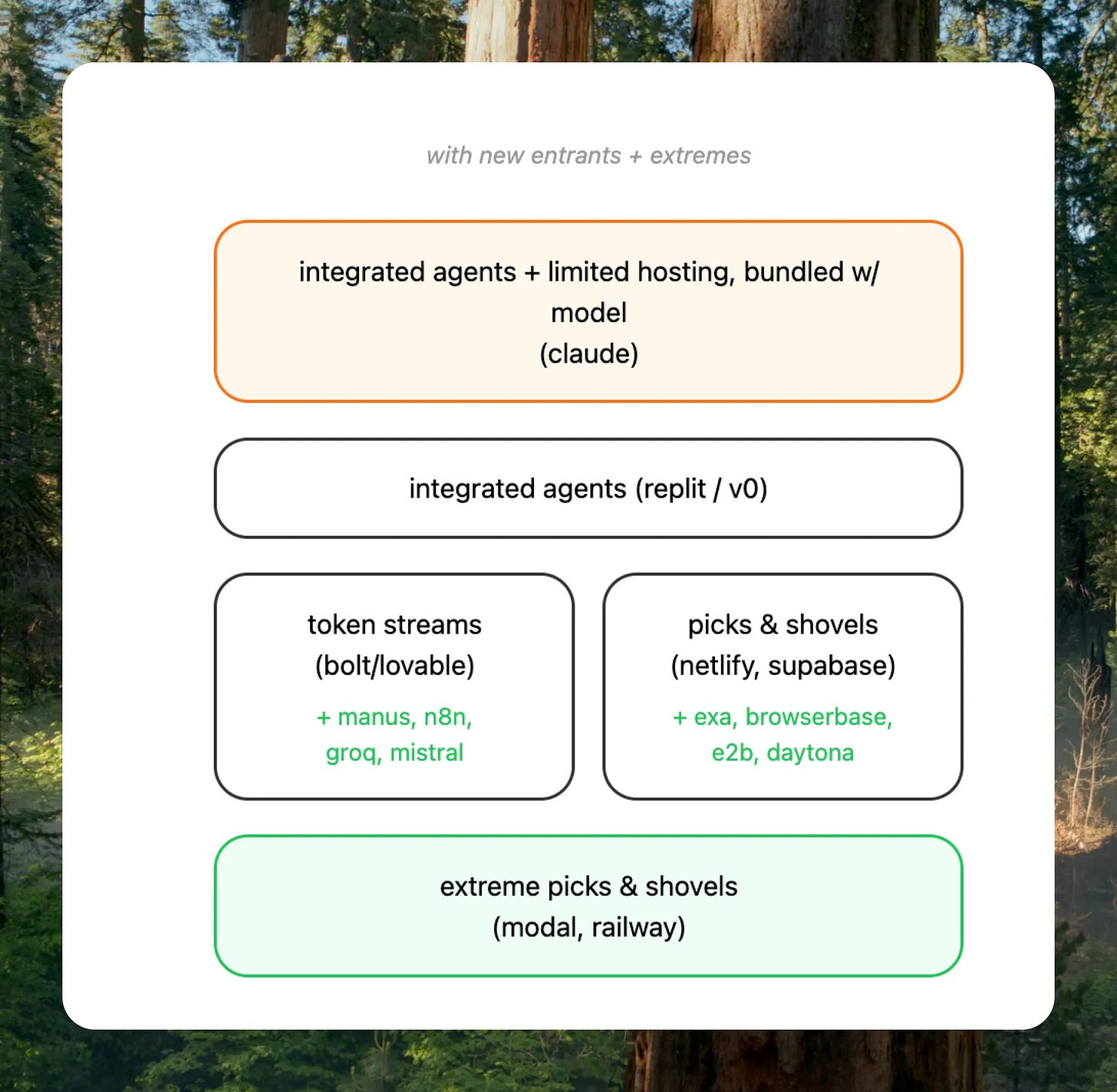

the vertical integration spectrum

watching how different players respond to this dynamic is fascinating. there’s a clear spectrum emerging:

the fully integrated agents (replit, vercel v0): landlords who own the entire building. every dollar of infrastructure margin stays in house. no netlify leakage, no supabase dependency. they control everything from code generation to hosting to databases.

pros: control distribution w/ sustainable margins

cons: hard to partner with

the token streams (bolt, lovable): uber drivers - bring all the customers, don’t own the cars. bolt burns $50 in tokens for $20 subscriptions while netlify captures 80% margins on the hosting. bolt just announced bolt cloud with netlify and supabase - trying to capture infrastructure margins through revenue shares since they’re driving 50% of netlify’s growth. classic prisoner’s dilemma.

pros: control distribution, extreme leverage on consumers, negotiating power to funnel against tools

cons: terrible margins, takes on principal risk, no easy path to margins w/o integrating

the picks and shovels (netlify, supabase, neon): infrastructure incumbents printing money on demand they didn’t generate. their years of developer experience investment suddenly paying off as ai agents flood their platforms. locked in a symbiotic dance with the token streams who desperately need their infrastructure.

pros: great software margins, demand surging

cons: at the mercy of the token streams to choose to use them or not

all token streams converge

everyone’s discovering they’re either a token stream of a tool, or both — and they all fit into the same dynamics —

n8n started as workflow automation and became a token stream now. groq and mistral started as model providers, now they’re token streams that have their own execution sandboxes too. even manus, that started as a general agent, is beefing up w/ more tools like hosting and slide making. the dynamic is clear: whoever controls the token stream has leverage — users consume tokens through you, you control where infrastructure demand flows, but your usefulness depends on the tools you can give the agent

meanwhile the real picks & shovels emerged. not langchain (orchestration) or braintrust (evals) like everyone predicted. those turned out to have zero place in the value stack. the actual infrastructure that matters is boring: hosting (netlify), databases (supabase), sandboxes (e2b), browsing (browserbase), search (exa). even gamma, who’s primary business is being a token stream for slide making, has released their slides making endpoint as an API.

the players on the extremes paint two versions of where the world can go:

anthropic (extreme vertical integration): on one extreme, anthropic is steamrolling the ecosystem one feature at a time. their own browsing instead of browserbase. their own search instead of exa. hostable artifacts instead of netlify. figma import via mcp of lovable. they’re teaching users that everything should be bundled and free, which works great when you’re the only one who can afford to bundle everything for free. once users get claude doing everything natively, why pay anyone else?

pros: extreme pricing power, internal synergies, no dependencies, can subsidize everything through model margins

cons: literally impossible to partner with, everyone wants you to fail, massive surface area to maintain

the effect is that they’ve built a death star and pointed it at their own ecosystem

modal and railway (pure efficiency play): on the other side, modal and railway represent a costco model of the cloud resources netlify makes their margins on — giving the token streams room to breathe and find some margin for themselves.

modal built everything in rust for sub-second launches. railway charges by the cpu cycle while running their own metal. they’re betting bolt hits 10 million users, looks at their $5m/month netlify bill, and realizes modal would do it for $1m. lovable’s already chosen modal over e2b for their sandboxes, which modal offers at a 500% lower mark up than e2b. one git commit moved millions in future revenue.

pros: impossible to beat on price/performance, will win when scale matters, token streams need them to survive

cons: requires scale for impact to be felt, weak takeoff, dependent on token streams actually reaching escape velocity

the kicker: these two extremes are racing toward collision. anthropic wants to own everything, modal/railway want to be the escape hatch when token streams realize they’re overpaying. every startup in the space is betting on which future arrives first.

the endgame

the spectrum is set. anthropic at one extreme going nuclear vertical. modal and railway at the other extreme betting on pure performance. everyone else stuck in the messy middle.

the real tell is in the margins. bolt loses money on every user while netlify captures 80% gross margins on bolt’s demand. that math doesn’t work. either bolt captures infrastructure value or becomes netlify’s most expensive customer acquisition channel before dying. it’s like being a drug dealer who’s addicted to their own product. bolt needs netlify’s margins to survive, but every dollar they send them makes their own death more certain.

my bet? the costco model wins. anthropic can’t maintain a thousand tools forever. but modal only needs to do one thing: run code cheaper. when bolt’s burning $100m/year and netlify wants $20m for hosting, that $15m savings suddenly matters. infrastructure margins compress from 80% to 20%, but 20% of everything beats 80% of nothing.

the lines are clear now: tools with margins on one side, token streams with demand on the other. we spent three years trying to eliminate developers. turns out we just eliminated their salaries. netlify’s still charging $8/month to host a website - they just don’t have to split it with anyone who knows how to code anymore.

every startup in the space is betting on which future arrives first.

next week or smt: aws / snowflake

thank you to joowon kim, paul klein, aman kishore, & andy jiang for reviewing

> lovable’s already chosen modal over e2b for their sandboxes, which modal offers at a 500% lower mark up than e2b.

I'm curious what pricing info you're using? e2b's advertised pricing for 2 vCPUs is $0.000028/s [1] which is about 30% cheaper than Modal's $0.00003942/s [2].

[1]: https://e2b.dev/pricing

[2]: https://modal.com/use-cases/sandboxes

stratechery called and they want their swagger back