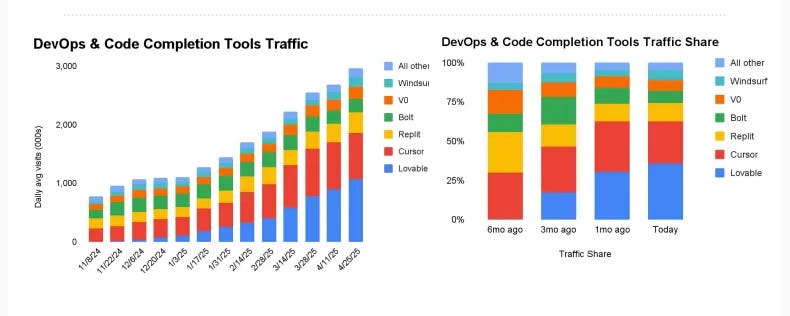

looking at the AI vibe coder wars, you'd think infrastructure would matter. StackBlitz spent seven years building WebContainers—an entire browser-based operating system that can run Node.js without a server. Replit built their own containerization system, their own collaborative editing engine, their own programming language. Years and years of infrastructure, of real computer science.

lovable doesn’t give a fuck. lovable showed up six months ago with what appears to be claude sonnet, a text editor, and the programming equivalent of thoughts and prayers. today? they're neck and neck — despite a categorically inferior team / product.

VCs tell founders that startups need to have good product, good leaders, and good coverage. but 11x was able to go from zero to $10m in ARR with:

a product that every user hates

a CEO that was forced to step down

multiple scandal news publications

while every product in the AI SDR category is hated by their users, it’s still entirely possible that the category will survive if the next AI wave bails them out.

if LLMs get just 10x better at writing emails that don't sound like they were composed by a Victorian ghost trying to sell you timeshares, the entire AI SDR category will print money. Including 11x. especially 11x, because they were there first, because they were there loudest, and because when the tide rises, it lifts all boats—but it lifts the boats that are already in the water a hell of a lot more than the ones still being built in dry dock.

welcome to the age of levered beta, where being smart is overrated and being early is everything.

you can’t fight the tape

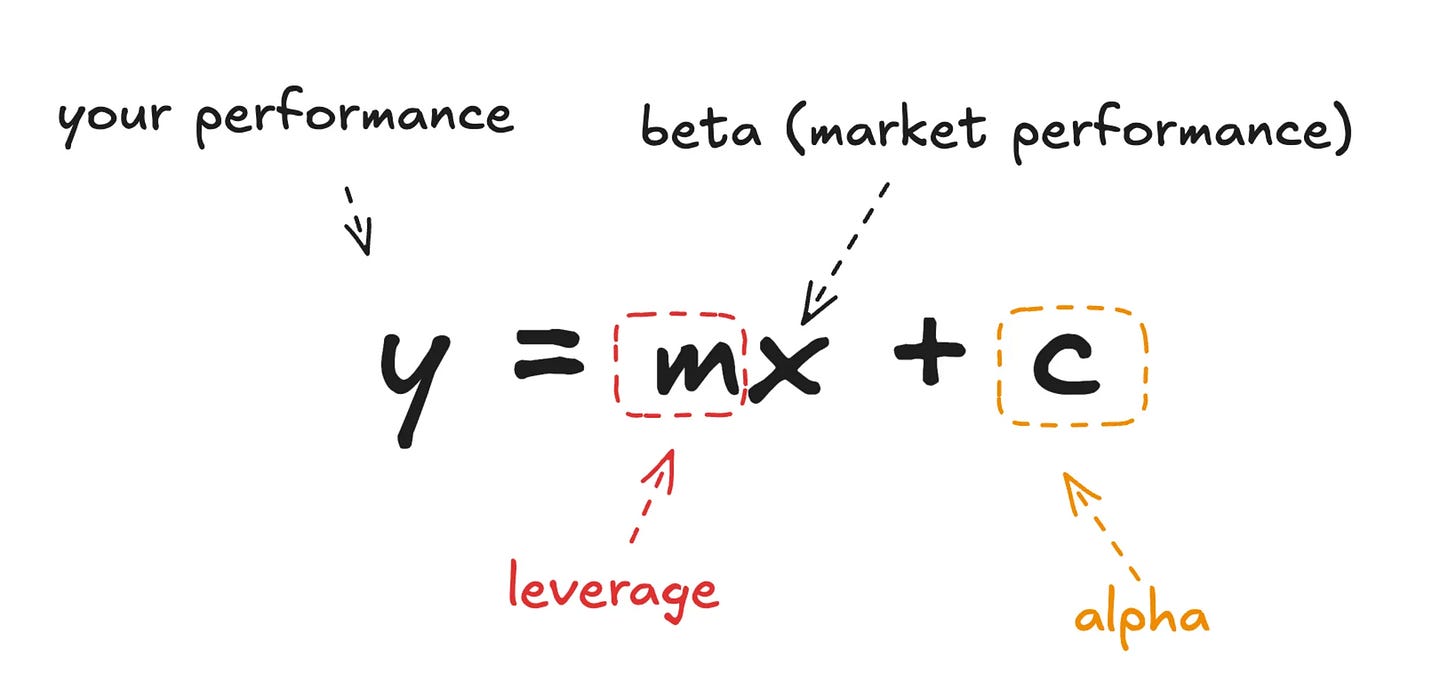

what’s beta? does it have to do with alpha?

in investing, "alpha" is your edge—the returns you generate above the market through skill, insight, or probably insider trading. it's Warren Buffett reading annual reports in Omaha. it's Renaissance Technologies' PhD army building algorithms that nobody else understands. alpha is hard. alpha is rare. alpha is what every founder thinks they have when they put "revolutionizing" in their pitch deck. if the market is down 10% and you’re only down 5% — you have alpha.

"beta" is just correlation with the market. when the S&P goes up 10%, your beta-1 portfolio goes up 10%. no genius required—you're just along for the ride.

"levered beta" is beta on steroids. you're not just riding the wave; you're surfing it on a rocket-powered surfboard you bought with borrowed money. when the market goes up 10%, your 2x levered beta portfolio goes up 20%. when it goes down 10%, well, that’s a problem for future you

the thing about alpha is that it's zero-sum. for every investor who beats the market, someone else has to lose. It's musical chairs with money. but beta? beta is abundant. beta is democratic. beta doesn't care if you went to Stanford or if you can't spell Stanford.

for the last decade, Silicon Valley has been obsessed with alpha. build something nobody's built! disrupt an industry! be so innovative that VCs write fawning blog posts about your genius!

but today’s markets are 100x more volatile than others, every single “path to $100M ARR” chart is getting more and more steep. in a market like that, what you want is to take a 100x levered stkae in the S&P500 and ride that index fund up.

oink if you love market trends

the AI SDR category is the perfect case study in levered beta triumphing over everything else we pretend matters — evne before the product works.

by any reasonable measure, these products are terrible. I mean genuinely, catastrophically bad. They write emails that sound like this:

Dear [FIRSTNAME],

I hope this email finds you well! I noticed you're the [TITLE] at [COMPANY] and wanted to reach out about how our revolutionary solution can transform your [INDUSTRY] through synergistic value creation and paradigm shifts.

Would you have 15 minutes next Tuesday at 2:30 PM EST for a quick call?

Best regards,

Definitely Not a Robot

and yet

aisdr raised at a $40 million valuation. artisan raised $11 million to build what they call "ai employees," which is somehow an even worse term than "ai sdr." clay went from data enrichment to ai sdr features, despite their core offering being an incredibly good product. 11x, despite everything, raised $50 million.

none of these companies have product-market fit in any traditional sense. their nps scores would make comcast blush. their churn rates are measured in days, not months. but they have something better: category-market fit. they're selling into a trend so powerful that quality barely matters.

every cro in america greenlit an ai sdr pilot in 2024, not because they thought it would work, but because everyone else was doing it. it's fomo was a strategy, and no one cared how much money they lit on fire because they needed to tell the board what they were doing with ai. and if the other competitors were showing up in ai sdr case studies, it was either "convince your board that you have alpha in not adopting ai" or "ride the wave".

this is levered beta in its purest form. the companies aren't good. the products aren't good. the timing is perfect.

and it’s entirely rational to do so, because if you believet that in the next 10 generations of foundation models, this company will work, and those next 10 will land in the next 2 years — well as long as you have enough money to stay alive until then and you keep taking up attention and space in the new york subway ads to make people angry, you’ll be fine.

white-label ChatGPT and the Harvey test

what does it look like when it starts to work? let’s take look at the legal AI space.

Harvey is basically ChatGPT with a legal prompt template. So is CoCounsel. So is Spellbook. So is every other legal AI company.

The tech stack is:

OpenAI API key

Some RAG over legal documents

A UI that looks lawyerly

A enterprise sales team that wears suits

A story about how you hired a ton of lawyers to tell you how to make the borders more lawyerly

that's it. that's the whole company. and Harvey's worth $1.5 billion $5B.

and here’s the thing — they’re worth it. they have the brand and distribution and vibes and narrative that makes law firms willing to buy ChatGPT — even tho it’s just chatGPT. there is no alpha, it’s literally just levered beta on OpenAI, where the lever is a nice suite and some serif fonts.

and OpenAI loves them. OpenAI just cares about token consumption. it would take them forever to paint a narrative on their own to convince law firms that the product that Joe 6-pack uses to make Ghibli cartoons can automate their work — so Harvey gets to package the same product with a story law firms buy. when they consume, those tokens flow back to OpenAI and they make money either way. Harvey’s entire company is basically a vertical specific sales team for OpenAI.

and I’d pay $5B for a vertical specific sales team for OpenAI’s R&D function that’s been king-made by Sam Altman.

replit & bolt's reality check

which brings us back to our code editors, and the most painful lesson in levered beta economics.

stackblitz and replit have elite engineering teams. seven years building webcontainers. training their own models. actual computer science. lovable shows up with claude and infinite marketing dollars.

here's what happens: when claude 4 drops and lovable gets 50% better overnight, users think lovable got better. they don't know it's claude. they don't care.

replit built something genuinely 30% better through engineering excellence. but if the model improvement is 50% and the engineering edge is 30%, consumers literally cannot feel replit's superiority. the model improvement swamps everything.

the math:

january: replit is 30% better than lovable

february: claude 4 drops, both products improve 50%

result: both feel "amazing" now, replit's edge invisible

users attribute ALL improvement to the product, not the model

every six months this happens again. another 50% boost. another round where engineering edges get lost in the noise.

if you're replit: every dollar spent achieving that 30% could have bought distribution. lovable gets this. while replit makes their product 5% better, lovable makes sure 5% more people know they exist. when the next model drops and erases that difference anyway...

bolt.new launches leveraging seven years of infrastructure. it's better than lovable. technically. objectively. marginally. invisibly.

in categories where llms are rapidly improving, r&d spend on marginal improvements is a vanity metric. the real game is distribution. be there when the wave hits, and make sure everyone knows your name when it does.

technical differentiation is supposed to be the alpha everyone chases. but when model improvements come in 50% chunks every six months, that engineering edge becomes a rounding error. it's building the world's best horse carriage in 1908.

how icon and cluely ride the rocket

as a response to how fast beta takes off when LLMs start to work, founders are starting to push for real estate speculatively, before the LLMs work at all.

the latest generation of levered beta plays aren’t products—they were performance art. technology companies as outrage influencers, burning cash on controversy to claim mental real estate before their products actually work.

icon.me: kennen davison looked at AI video generation—which was producing absolute garbage, nightmare fuel that made stock photos look like spielberg—and made a bet: this tech is coming, just not yet. so he dropped ungodly money on a domain and launched with a product that had 90% weekly churn.

he knew it was trash. everyone knew it was trash. but that wasn't the point.

davison was playing a different game: claim the territory now, survive until the technology catches up. when sora or veo-3 or whatever finally makes AI video not suck, who's going to own the mindshare? the company that waited until the tech was ready? or the one that's been screaming "AI ADMAKER" for two years straight?

cluely played the same game with even more aggression. their AI coaching tool was vaporware, but they bet that conversational AI would eventually work. so they raised $5.3M and spent it on outrage—a manifesto calling cheating "leverage," a viral video of their founder lying on dates. 7.8 million views. "black mirror dystopian," everyone screamed.

perfect. because when real-time AI coaching actually works, everyone will remember them.

the genius is in the timing calculation:

the tech WILL get good

they need to survive until then

they need to own the mindshare when it arrives (hence the outrage)

it's a three-variable equation: burn rate vs. tech timeline vs. brand toxicity. spend too fast, you die before the tech arrives. get too toxic, you're radioactive when it matters. but nail the balance? you're the default choice when the future arrives.

these companies know their products are garbage. they're not delusional—they're patient. they're buying lottery tickets on GPT-6, on the next generation of video models, on the inevitable march of progress. their 90% churn isn't a failure metric; it's a holding pattern.

icon claims $5M revenue with 16 people and catastrophic retention. that's not a tech company—that's a marketing agency with a waitlist, burning money to stay alive until their bet pays off. notice how they haven’t given any updates on their revenue since that $5M number

these companies are all lying and hoping the models catch up. but like most lies, this one has a timer on it.

it works tho, i bet you can’t name another AI sales coaching startup than cluely, or another ai ad maker than icon.

the brutal truth about llm businesses

here's what nobody wants to admit: when llms finally work at something, the implementation will be boring as fuck.

harvey isn't some breakthrough in legal ai—it's chatgpt with a law degree costume. lovable isn't revolutionizing coding—it's claude with pretty buttons. the ai automation tools aren't building the future—they're zapier with chatgpt steps.

the technology works. right now. today. the "innovation" is just permissions and packaging.

so you have two choices:

option 1: wait until the llm actually works, then scramble to build your chatgpt wrapper alongside everyone else who just realized the same thing.

option 2: start now, while the tech is still garbage. lie about how good it is. burn money on marketing. claim the territory while everyone else is still laughing at you.

the companies winning at levered beta aren't the ones building better products. they're the ones who understood this dynamic first. they're either lying about the present (11x, icon.me) or arbitraging the obvious (harvey, lovable).

both strategies work because they're playing the same game: be the default option when everyone realizes the emperor has no clothes—and that nobody cares.

this isn’t a “this is so fucked up, everyone’s a fraud” type article. this is actually the correct strategy. in a world where foundation models improve 10x every 18 months, building infrastructure is like decorating a house you're about to demolish. the smart money isn't on building the best product - it's on being the default option when the underlying tech finally works.

the companies spending millions on R&D are playing checkers. the white-label ChatGPT wrappers are playing chess. and OpenAI? they're playing Monopoly, and they already own Boardwalk."

Thank you to Andy Jiang, Nnamdi Iregbulem, Paul Klein, and Nikunj Kothari for reading drafts of this

The "levered beta" insight is spot on - when tech improves this fast, traditional moats crumble.

But there's a key difference between being early and having real distribution.

Harvey looks like ChatGPT in a legal costume, but they seem to be doing something much smarter: creating workflow dependencies. Once firms build their document templates, train staff, and structure approval processes around Harvey, switching becomes painful regardless of model improvements.

The real play isn't alpha vs beta. it's managing the transition. Ride the LLM wave while building infrastructure that matters post-commoditization. Use current users to map future workflow needs.

Replit's infrastructure bet suddenly looks genius. When AI-generated code becomes table stakes, advantage goes to whoever controls deployment and scaling.

This "levered beta" moment won't last. Folks that are gaining edge are using today's hype to embed themselves so deep into workflows that removal becomes unthinkable.

This is an excellent argument. I'm sending it back in time so I know to invest in Webvan and Pets.com