windsurf gets margin called

what the windsurf sale means for the ai coding ecosystem

the $82 million ARR product nobody wanted

imagine you relaunch your company twice, and manage to become one of the fastest-growing saas companies in history — literally record-breaking. go from zero to $82m arr in eight months. get enterprise customers like nvidia and palantir. go on every single vc podcast to tell people about it.

then give it all away for almost free. in 72 hours. over a weekend.

that's exactly what the windsurf founders did last week. everyone's so busy talking about the talent or the equity of the team that was left behind, they’re not asking “why did you sell one of the fastest growing products in history for nothing?”

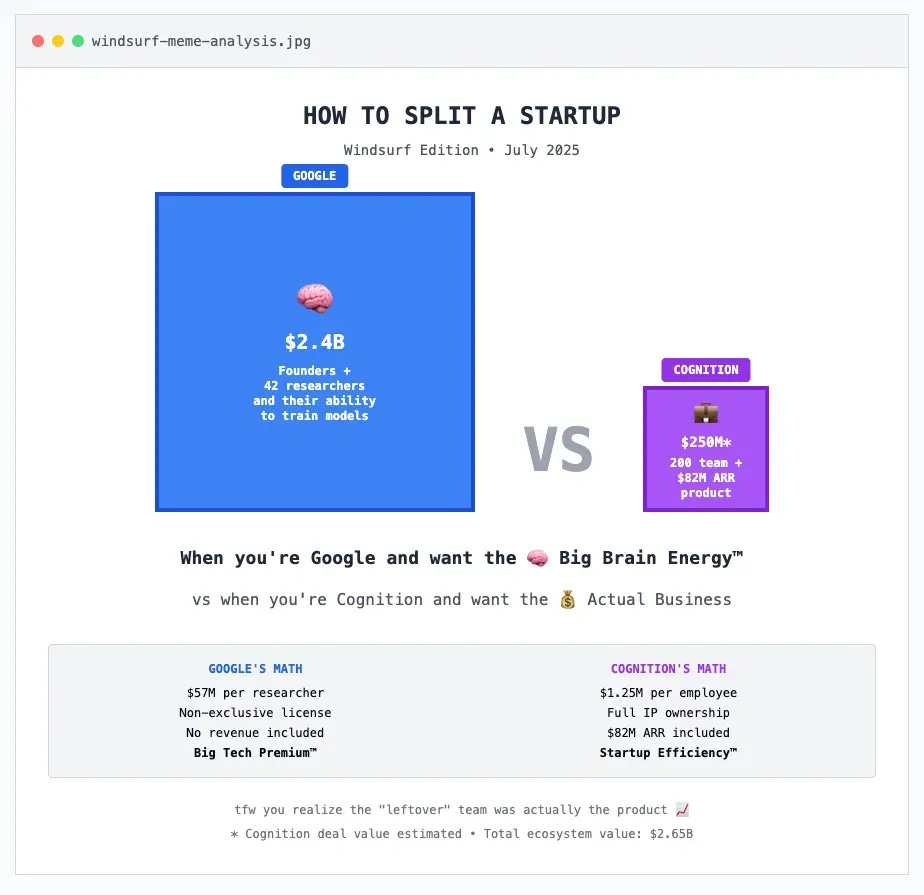

after the acquisition, windsurf was left with about $100M on the balance sheet — cognition acquired the company for $250M — this means the enterprise value of the company [ignoring the cash] was $150M…

you have a business that went from 0 - $82M ARR in 8 months that no one wanted to touch, and the best offer was for a less than 2x multiple?

what the fuck was so broken that the founders would rather leave it behind for almost nothing, and

a timeline of totally normal business decisions™

let me walk you through a totally normal corporate divorce since [checks notes] last week:

thursday, july 11: openai's $3b acquisition of windsurf falls apart. after months of negotiations, they walk away.

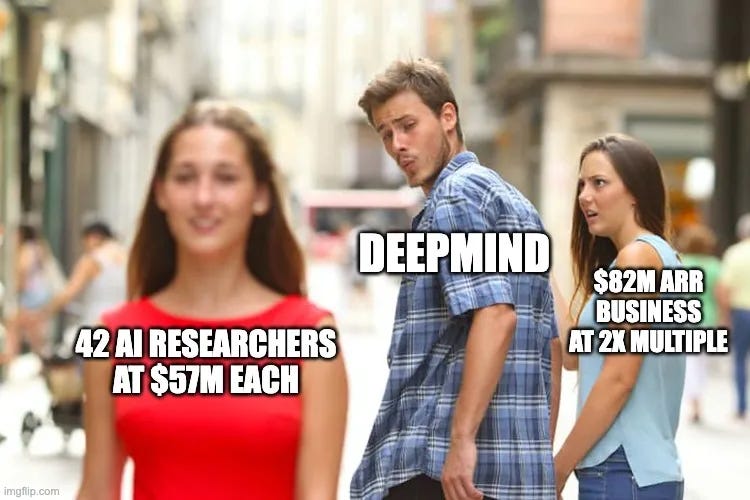

also thursday, july 11: google announces they're paying $2.4b to hire windsurf's ceo and 41 researchers for deepmind. not to acquire windsurf. just the humans. the same day openai walks. what a coincidence!

friday afternoon: windsurf's founders—or what's left of them—make their first call to cognition. not "let's explore options." not "let's take our time." just: "you want a company?"

monday morning: deal signed. cognition gets the entire business—$82m arr, 200+ employees, all the ip—for basically the loose change in reed hastings' couch.

so let's recap: google swoops in the exact moment openai bails, cherrypicks the leadership team for $2.4b, and leaves behind a headless $82m arr company like a half-eaten sandwich.

at $57 million per engineer, that's either the greatest talent arbitrage in history or the most expensive acquihire cope of all time.

the punchline? google's deal explicitly excluded the actual business. they looked at $82m of arr and said "nah, we're good."

when buyers are paying billions for your employees but won't touch your revenue with a ten-foot pole, you're not running a business—you're running an extremely expensive temp agency.

the negative margin death spiral

windsurf's ceo once let slip that their $10/month plan had "not much margin." this is like saying the titanic had "not much buoyancy."

the whisper network on twitter has been screaming about this for months:

@jsnnsa claims -300% negative margins: "revenue? sure but their revenue is what will kill them. you pay them 1$ they pay ant 3$"

@opencv goes even harder with -500% margins: "Cursor is dead in 12 months. It's worse than anyone knows. Money is being incinerated"

@tenobrus spells it out: "both cursor and windsurf are absolutely bleeding VC money on every call btw"

when @andersonbcdefg points out that claude code charges $5/day ($150/month) as a "good proxy for how much those 'should' cost," you start to see the problem. cursor charges $20/month. windsurf charges $15/month. they're selling dollar bills for quarters.

based on the forensics:

cursor: 50 employees, $42m/month revenue, but $53m/month implied burn

revenue per user: $20/month

api costs for power users: $80-200/month

margin on heavy users: -300% to -500%

every new customer makes the problem worse

here's why this is a death spiral:

you can't raise prices (claude code is your competition)

you can't cut costs (api bills are fixed)

you can't stop growing (that's your only story)

you can't pivot (you've raised too much)

at that point - you need to either find another way to bring down the costs or… look for an exit?

the margin call that forced the sale

i noted something in my last piece:

it's a three-variable equation: burn rate vs. tech timeline vs. brand toxicity. spend too fast, you die before the tech arrives. get too toxic, you're radioactive when it matters. but nail the balance? you're the default choice when the future arrives.

windsurf and cursor were playing the same game — levering up huge by using VC money to subsidize anthropic’s models (rumor says Cursor is 20% of Anthropic’s growth). their tech timeline wasn’t frontier performance, but their own ability to develop cost efficient models before they run out of money, or lose all their customers to claude code

use vc money to subsidize api costs

collect massive training data from developers

train your own models before money runs out

flip from -500% margins to positive overnight

that's why cursor tried to poach anthropic researchers (and the researchers staying at anthropic might be a sign they can’t do it). that's why windsurf rushed out SWE-1. they weren't building coding tools—they were building datasets with a fancy ui.

as @jsnnsa noted: "if their plan is to compete with anthropic then they'll be bankrupt by next summer. they have no research talent, little capital, and a money-hungry dumpster fire burning a hole in their pocket"

cursor might do totally fine despite losing the anthropic researchers. they've got thrive's infinite money printer, they raised early and have the lead, maybe they clutch out a kimi-type model. my prediction is that anthropic acquires them — they might already be in talks, but either way with the surge in popularity of claude code, cursor might be feeling like bear sterns in summer of 2007

windsurf was behind and out of time, bear sterns in 2008. they needed either:

api costs to drop 10x (not happening)

their models to beat anthropic (delusional)

someone else to hold the bag (ding ding ding)

when you're burning millions per month and your supplier launches a competing product at 1/7th your price point, you don't have a margin problem—you have a margin call.

what does this mean for ai coding?

windsurf's fire sale proves what we've been avoiding: the coding part has no value capture — and claude code is coming. they're racing against irrelevance. and they're not alone

bolt and replit aren't bleeding cash like cursor/windsurf—they're not subsidizing every api call. but they're sitting on a different time bomb:

mediocre margins at best

users build an app then aren’t reliably going to do more stuff

claude code is coming for their lunch

their entire value prop evaporates the second anthropic decides to add a "deploy" button

but here's the twist: at least we're not low-code tools, bc since i last wrote, the low-code apocalypse arrived:

figma launched text-to-ui

retool released ai app builder

airtable dropped their own "describe what you want" feature

notion is pushing ai-powered app creation

low-code ui builders are out. whatever the fuck this text-to-app paradigm is, it's in. squarespace and webflow announcements incoming in 3... 2... 1...

but these are if the coding layer is worthless, what isn't?

hosting infrastructure: netlify doesn't write code, but bolt drives massive traffic to it. when everyone's building apps with ai, someone still needs to host them. boring, profitable, sustainable. replit rolls this in house, notion has a light version of this.

databases: supabase is laughing. every ai-generated app needs data storage. they don't care if you wrote the code or claude did. this is why turning their tables into databases, retool released hosted databases, and airtable is entering the space at all

workflow automaton: running workloads on cron jobs with ec2 instances is very much still valuable — you see retool, zapier, and airtable also enter from that perspective

seo optimization: webflow still owns this. lovable and bolt roadmaps are desperately trying to add seo features because that's where actual value lives, and notion has made some forrays

basically all the services that low code platforms had to bulid out in the past, like auth / security / rbac / latency

the infrastructure that manages code is still worth something — and at this point i’d say more of replit’s value is in being able to serve the code you make in it the way netlify does, than in bolt — bolt is more of a distribution engine for netlify where replit is bundling the whole thing together. if bolt can't figure out some defensible angle (maybe they carve out seo as a niche?), i might be writing them to zero.

the $57 million dollar education program

let's be clear: $2.4 billion isn't a fire sale. everyone kinda made the money they wanted. just not for the reason VC investments typically make money

google didn't buy a company. they bought 42 researchers who'd spent $200+ million of vc money learning how to train coding models. at $57 million per head, that's the most expensive education program in history.

here's what actually happened:

vcs pump $200m into windsurf

windsurf uses that money to buy gpus and training data

42 engineers learn incredibly valuable skills

google pays $2.4b for those skills

the actual business (82m arr) gets sold for pocket change

the company—its revenue, customers, product—was worth maybe 1.8x revenue. that's a rounding error on a series a. but the expertise? that's worth billions.

this is the insane state of ai talent wars. windsurf accidentally discovered the ultimate arbitrage: raise vc money to train yourself on expensive gpus, then sell your newly-acquired expertise to the highest bidder. it’d be like if uber and lyft both collapsed, but waymo was willing to acquihire their teams for $20B, just for the expertise they developed on rolling out ridesharing operations

imagine pitching this to sequoia: "give us hundreds of millions, we'll use it to teach ourselves such valuable skills that google will acquihire us for $50m each." they'd throw you out. but that's exactly what happened.

it's a great outcome for the founders, and investors, employees. genuinely, congrats to them. but treating this like a successful business exit is missing the point entirely.

windsurf wasn't a company. it was an accidentally subsidized training program that discovered the most valuable output wasn't code — it was coders who knew how to build coding models.

the vcs funded a $200m scholarship program and google paid the tuition refund.

the margin calls are coming

but here's the thing: this escape hatch isn't available to everyone. windsurf got bailed out because they accidentally became an ai research lab, and cursor is probably going to be fine as well, for the same reason.

the windsurf "acquisition" set a precedent, but it's a dangerous one. everyone's looking at the $2.4b number and missing the real story: a business doing $82m arr couldn't find a buyer at any price.

that's not a success story. that's a warning.

the margin calls are coming. not everyone gets to answer them by selling their homework.

thanks for Nikunj Kothari and Benn Stancil for reviewing

What I'm not so sure of is: The Windsurf founders learned "incredibly valuable" skills? Really? By running a fork of VS Code with an AI plugin for a few years? Because they tried to build their own LLMs, that weren't that good? Why does Deepmind want them?

Google also received a license for Windsurf IP which is a pretty glaring omission from this perspective. They are going to ship Gemini CLI IDE something-something and probably do billions in revenue if they execute well.